One of the most important ways to protect your finances is long-term care insurance.

Most people are surprised when I suggest adding that coverage to their financial plan. However, if you plan on living past 65, you need a strategy to keep the cost of your future care from eating your savings.

Nearly 70% of seniors age 65 or older will need some form of long-term care. About 20% of these seniors will need such care for 5 or more years.

That’s why it boggles my mind that a mere 8% of people carry long-term care insurance.

Long-term care insurance pays for costs that are NOT covered by regular health insurance. Most people don’t realize that they’d likely be on their own covering those expenses.

It’s not pleasant to think that you might need to live in a nursing home rather than traveling, hosting parties in your own home, and finally pursuing your masterpiece.

But ignoring the very real risk is a big mistake.

Long-term care insurance could be the difference between a comfortable life you can easily afford… and one where your children struggle to pay for your most basic bills.

Why Medicare and Medicaid aren’t enough

Medicare and Medicaid will probably not cover the cost of long-term care. To start, Medicare is limited to a max of 100 days of care after a hospital stay. It will NOT cover any kind of supervision or personal care needs.

Medicaid might be an option, but it is extremely limiting. To qualify, you must have very little income and very limited assets. Many care facilities won’t take Medicaid, which limits your choices.

In either case, Medicare and Medicaid would ONLY kick in if you have specific medical needs.

Long-term care insurance, on the other hand, is much more flexible and gives you a lot more freedom. It covers the cost of care for chronic medical conditions. Plus, it covers services that would not count as “medically necessary” under regular health insurance.

For instance, many seniors need help with daily tasks such as bathing, eating, using the toilet, dressing, or getting in and out of bed. Long-term care insurance is designed to cover these very real needs.

Long-term care insurance can help you stay in your own home longer by paying for in-home care or adult day care.

When to invest in long-term care insurance

At this point, my clients often protest, “But Michael, I’m only in my 50s! I still have plenty of time to think about that.”

Investing in long-term care insurance when you’re young is actually the BEST time to get it!

Like many forms of insurance, the younger and healthier you are when you apply for it, the cheaper your rate. Insurance companies will NOT open a long-term care insurance policy for someone already in need of using it. At that point, you would be plumb out of luck.

Likewise, it is near impossible for most people over the age of 75 to purchase a new policy.

A potential financial disaster

Currently, an American turning 65 today will pay more than $120,000 in long-term care some time in the future. Their families will pay more than 39% of those costs.

Without the security of this insurance, these seniors often quickly burn through all their hard-earned retirement savings when they need to transition to assisted living or a nursing home.

That’s a big factor for why 80% of seniors are at risk of economic insecurity — or already there. 60% of these seniors would be unable to afford just two years of long-term care.

The following are the current average of long-term care costs. By the time you need these services, the costs will surely be much higher.

| National Average Costs of Long-Term Care | |

| Semi-private room in a nursing home | $6,844 a month or $82,128 a year |

| Private room in a nursing home | $7,698 a month or $92,376 a year |

| 1-bedroom assisted care unit | $3,628 a month or $43,536 a year |

| Home health aid | $20.50 per hour |

| Homemaker services | $20 per hour |

| Adult day care center services | $68 per day |

Source: Administration for Community Living

In comparison, investing in long-term care insurance now can save you thousands of dollars later. Paying decades of insurance premiums could still be less than a single year in a nursing home or assisted living facility.

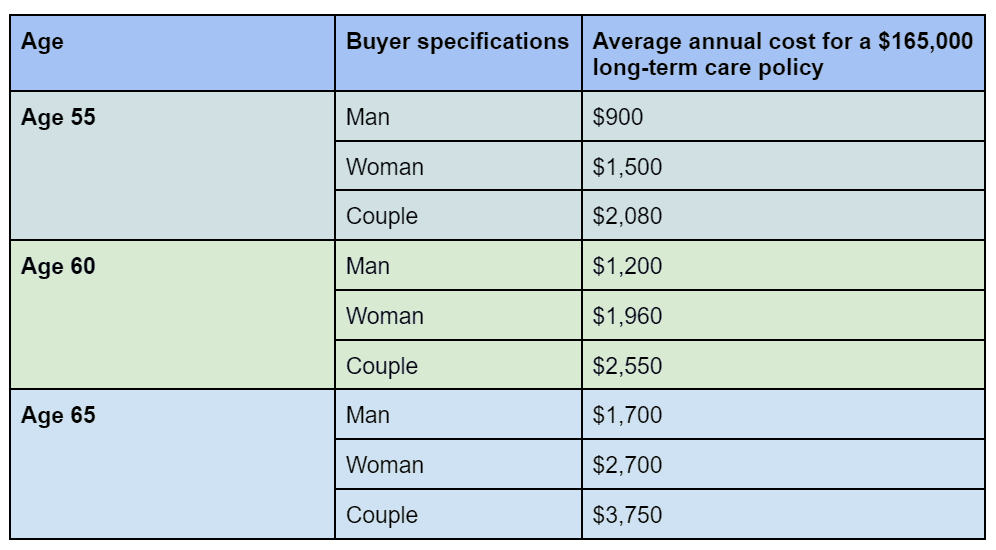

Factors like your age, gender, existing health, riders, amount of coverage, whether you have individual or joint coverage, and the insurance company itself will impact your initial and ongoing insurance premiums.

While insurance costs do go up as you age, even the accumulated cost of insurance premiums is significantly less than what you would pay out of pocket for long-term care services. See the chart below for proof.

Source: American Administration for Long-Term Care Insurance

For a little more each year, you can also build in an inflation growth provision to help protect against future inflation costs. These are often to factor in 1% or 5% inflation so you can feel confident your policy will cover the current costs when it comes time to need it.

Hybrid policies offer flexibility

Traditionally, long-term care policies would only cover in-home services or monthly care at an assisted living or nursing home facility. These days, you have even more choices.

Some carriers offer hybrid policies, packaging them together with life insurance or annuities so you gain more flexibility in how you can use it.

This helps eliminate the risk of paying for long-term care insurance for years but never actually needing it. In this case, it might award your family a “death benefit,” similar to life insurance. Or, you may be able to draw upon it in retirement, similar to an annuity.

Let’s find the perfect policy customized to your needs.

Together, we protect your future

To me, financial success is peace of mind. It’s knowing that your children won’t be burdened with your care.

It’s the relief your children feel, knowing parents will be well cared for until the end of their days.

It’s knowing that — even in your senior years — you have the power to make decisions about your own care, where you live, and what services you receive.

Together, we can map out a secure future without breaking today’s bank. Reach out today for a free consultation.